In today’s hyper-connected world, our digital footprints are larger than ever. We shop, socialize, bank, work, and even store personal records online. While this convenience is undeniable, it also opens the door to a serious threat: identity theft.

From data breaches to phishing scams, identity theft affects millions of people every year. In fact, according to the FTC, there were over 1.1 million identity theft reports in the U.S. alone in 2023. That’s not just a statistic—it’s a wake-up call.

The good news? You can take concrete steps to protect your identity online. Whether you’re a casual internet user or a frequent digital shopper, this guide will walk you through the best practices, tools, and habits to keep your identity safe in the digital age.

What Is Identity Theft?

Before diving into protection strategies, it’s important to understand what identity theft really means.

Identity theft is the act of stealing someone’s personal information—like Social Security numbers, bank details, login credentials, or even medical records—to impersonate them or commit fraud. This can lead to:

- Unauthorized purchases

- Opened credit cards or loans in your name

- Stolen tax refunds

- Medical or insurance fraud

- Damaged credit and financial loss

Often, victims are unaware of the crime until the damage has been done. That’s why proactive protection is key.

1. Use Strong, Unique Passwords

This may seem basic, but it’s one of the most effective ways to protect your identity online.

Best Practices:

- Avoid using the same password across multiple accounts.

- Use at least 12 characters, including numbers, symbols, and a mix of uppercase and lowercase letters.

- Avoid obvious choices like “123456,” “password,” or your birthdate.

Use a Password Manager:

Tools like 1Password, Bitwarden, or LastPass can generate and store complex passwords for you. That way, you only need to remember one master password.

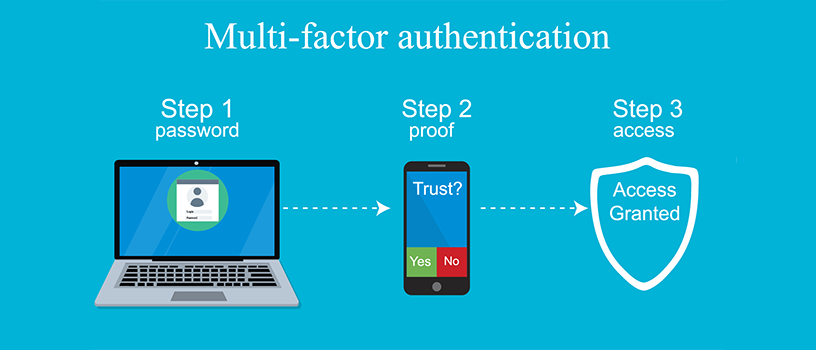

2. Enable Multi-Factor Authentication (MFA)

Multi-Factor Authentication adds an extra layer of security by requiring you to verify your identity with a second method—like a code sent to your phone or an app-generated number—even after entering your password.

Why It Matters:

Even if a hacker steals your password, they still can’t log in without that second verification step.

Where to Use MFA:

- Email accounts

- Online banking

- Social media

- Cloud storage (Google Drive, Dropbox, etc.)

- Shopping sites like Amazon or eBay

Pro Tip: Use app-based MFA (e.g., Google Authenticator, Authy) rather than SMS when possible—it’s more secure.

3. Be Cautious with Public Wi-Fi

Public Wi-Fi is convenient but notoriously insecure. Hackers can intercept your connection and steal data from your device.

Safe Browsing Tips:

- Avoid logging into sensitive accounts (banking, email) on public Wi-Fi.

- Use a VPN (Virtual Private Network) like NordVPN or ExpressVPN to encrypt your connection.

- Turn off auto-connect features on your device for public networks.

4. Watch Out for Phishing Scams

Phishing remains one of the most common tactics used by cybercriminals to steal personal information.

Common Forms:

- Emails pretending to be from banks, delivery services, or tech support

- Fake login pages

- Suspicious text messages or DMs on social media

How to Spot a Phishing Attempt:

- Check the sender’s email address (is it misspelled or strange?)

- Hover over links before clicking to preview the URL

- Look for poor grammar or urgent language like “Your account will be locked!”

If something feels off, don’t click—go directly to the official website instead.

5. Keep Your Software and Devices Updated

Outdated software can leave you vulnerable to known security exploits.

What to Update Regularly:

- Operating system (Windows, macOS, iOS, Android)

- Web browsers (Chrome, Firefox, Safari)

- Antivirus software

- Apps (especially banking or social media apps)

Enable Automatic Updates:

Where possible, turn on auto-updates to make sure you’re always running the latest, most secure version.

6. Limit the Personal Information You Share Online

The more you share, the easier it is for scammers to impersonate you or guess your passwords.

Be Mindful On:

- Social media: Avoid posting your birthdate, address, or pet’s name (commonly used in security questions).

- Online forms: Only provide required information. Don’t overshare on quizzes or contests.

- Job sites: Avoid including full contact info on public resumes.

7. Secure Your Mobile Devices

Your phone likely holds access to your email, banking, and many other sensitive accounts. Treat it like a digital vault.

Key Tips:

- Set a strong passcode or use biometric security (Face ID, fingerprint)

- Enable “Find My Device” to remotely lock or wipe your phone if it’s lost

- Avoid downloading apps from unknown sources

- Regularly review app permissions

8. Monitor Your Financial and Credit Activity

Being proactive is great—but being vigilant is just as important. Regular monitoring helps you catch suspicious activity early.

How to Monitor:

- Check your bank and credit card statements at least weekly

- Set up account alerts for large transactions

- Use free tools like Credit Karma or Mint to track credit changes

- Request a free annual credit report from AnnualCreditReport.com

If something looks unfamiliar, report it immediately to your financial institution or the credit bureau.

9. Freeze or Lock Your Credit

A credit freeze restricts access to your credit report, making it harder for identity thieves to open accounts in your name. It’s free and can be done online.

Where to Freeze:

- Equifax

- Experian

- TransUnion

A credit lock is similar but often offered through credit monitoring services or apps. Freezing is considered slightly more secure since it’s governed by federal law.

10. Use Reputable Security Software

Installing trusted antivirus and anti-malware software adds another layer of defense against threats like spyware, keyloggers, and trojans.

Features to Look For:

- Real-time threat detection

- Safe browsing tools

- Ransomware protection

- Email attachment scanning

Popular options include Norton, McAfee, Bitdefender, and Malwarebytes.

Bonus: Be Cautious with AI Tools and Face Filters

Newer threats involve AI-generated content and deepfakes. Some apps can even use your facial features to generate models that can be misused for fraud.

- Avoid uploading personal photos to unknown platforms

- Read privacy policies before using face-swap or age-progression filters

- Think twice before sharing voice or video clips publicly

Signs Your Identity May Have Been Stolen

Be on the lookout for these red flags:

- Unfamiliar charges or accounts on your credit report

- Denied loan or credit application for no clear reason

- Bills or mail addressed to someone else at your address

- Notification from the IRS about a tax return you didn’t file

- Password reset emails you didn’t request

If any of these happen, act fast:

- Contact your bank or credit card company

- Freeze your credit

- File a report with the FTC at IdentityTheft.gov

Final Thoughts

Protecting your identity online isn’t about paranoia—it’s about preparation. Cybercriminals are getting smarter, but so are the tools and strategies available to the rest of us.

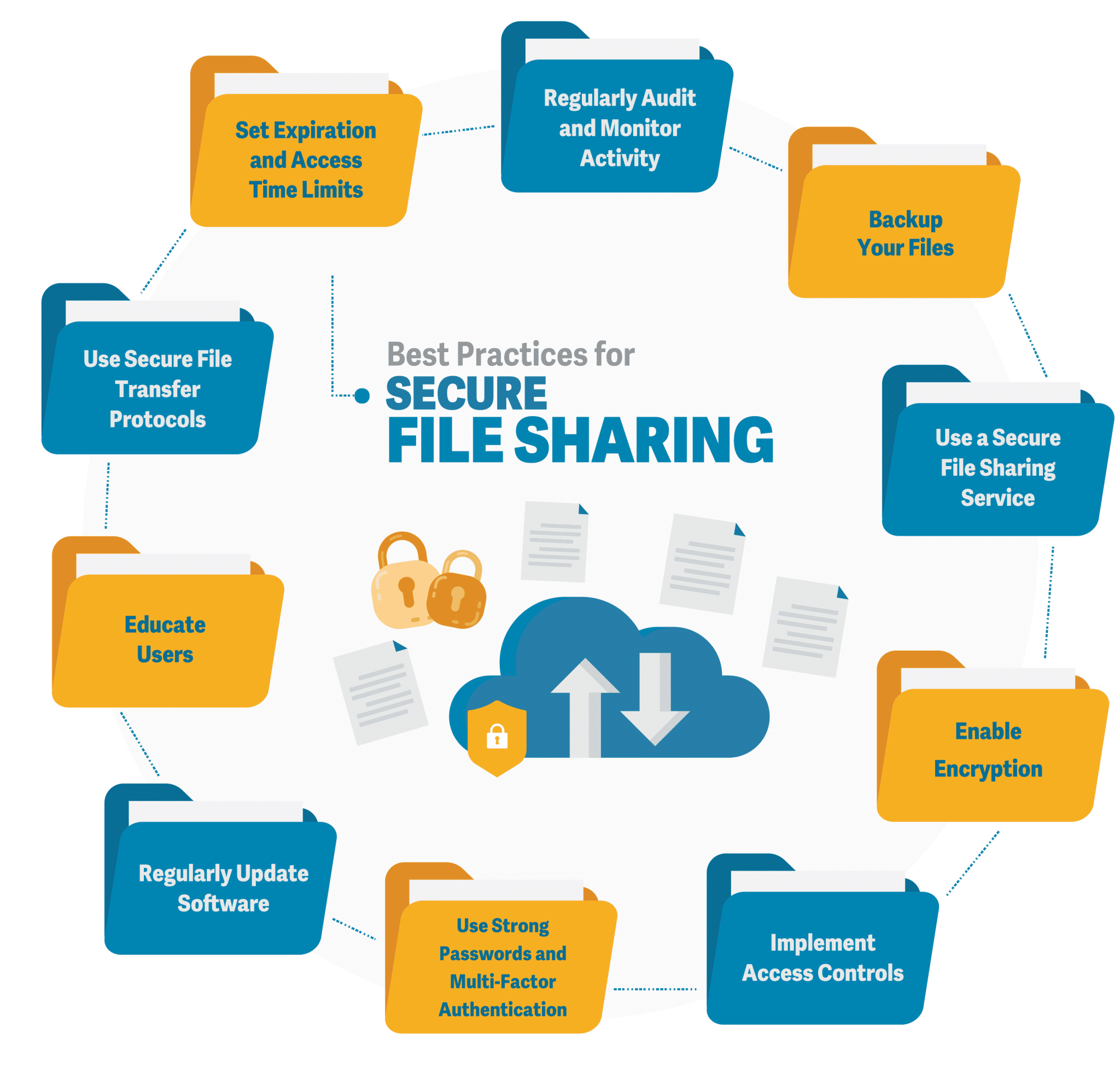

By using strong passwords, enabling multi-factor authentication, being cautious online, and staying vigilant with monitoring, you can dramatically reduce your risk of becoming a victim.

Identity theft can be costly, time-consuming, and emotionally draining. But with the right habits and tools, you can stay one step ahead and keep your personal information where it belongs—private.

✅ Quick Recap:

- Use strong, unique passwords + a password manager

- Enable MFA wherever possible

- Avoid public Wi-Fi for sensitive tasks

- Recognize and avoid phishing scams

- Keep software and devices updated

- Limit what you share online

- Monitor accounts and credit regularly

- Freeze your credit for added security

- Use antivirus tools and stay alert

Stay informed, stay protected, and keep your digital identity secure.